-

86-21-63895588

86-21-63895588

-

Harbour Ring Plaza, No.18 Middle Xizang Road Huangpu District, Shanghai, China 200001

Harbour Ring Plaza, No.18 Middle Xizang Road Huangpu District, Shanghai, China 200001

Release time:2023-03-16

China achieved an important climate milestone in September 2021 when it unilaterally announced that it would stop building new coal-fired power plants abroad. A belief that this was driven by climate considerations and international pressure overlooks a distinctive dichotomy: China announced its overseas coal exit while not changing its basic approach to domestic coal plants. This is in the reverse order of other countries (e.g., Germany announced a domestic coal exit law, then a stop to public funding for overseas coal) and seems incongruent because both China’s overseas and domestic coal investments depend on the same institutions and enterprises for finance and top-down policy signals and support. Analysis of this dichotomy suggest drivers that are at odds with a common view of China’s approach to the environment, that of top-down steering with bottom-up implementation (1) or “authoritarian environmentalism” (2). This raises important issues in climate governance and offers insights on how to cooperate with China on green development.

China has become the world’s greatest source of greenhouse gas emissions, and its biological diversity at home exhibits high vulnerability; internationally, China’s influence through trade, finance, and investment—not least through its Belt and Road Initiative (BRI)—is among the biggest in the world, with severe biodiversity and climate implications (3). Given the scope and scale of China’s influence, reduction of global environmental risks, such as climate change and biodiversity loss, cannot succeed without transforming China’s domestic and international economy.

Drivers of China’s Coal Dichotomy

China was the world’s largest public financier of overseas coal plants between 2006 and 2021 (4), completing about 54 GW of coal-fired power plants in 20 countries from Vietnam to Pakistan and from South Africa to Bosnia and Herzegovina (5). Domestically, China operates 49% of the world’s coal capacity of 2046 GW and has another 251 GW of coal-fired power plants under development (5).

China’s success in building overseas coal plants rested on a perceived low-risk model. China used its considerable domestic coal expertise in what were frequently noncompetitive government-to-government agreements with host countries or competitive bids based on an “all-China” offer: Chinese power plant developers—all state-owned enterprises—were responsible for building, operating, and/or owning the coal plants. Overseas projects were most often financed through Chinese policy banks (e.g., China Development Bank and Exim Bank of China) or state-owned commercial banks (e.g., Industrial and Commercial Bank of China). To cover credit and other risks, Chinese financiers required insurance by China’s government overseas export credit agency Sinosure, which itself required sovereign guarantees from the recipient country’s government (e.g., to guarantee payments under the power purchasing agreement).

However, particularly since 2019, economic, social, and political risks in China’s overseas markets changed demand considerably (see also table S1 ): Multiple recipient countries reevaluated their electricity needs because of lower-than-expected economic growth, which caused, for example, Egypt’s proposed 6.6-GW Hamrawein plant to be shelved in April 2020 and Bangladesh to request that China reduce financing for agreed coal plants in February 2021. Other countries (e.g., Vietnam, Pakistan) announced a focus on green energy and accelerated their net-zero targets. Other recipient countries were confronted with domestic social pressure against coal, such as the decoalinize movement that caused Kenya’s 1.2-GW Lamu coal-fired power plant to stop construction in June 2019. Broader social concerns became evident when 263 environmental nongovernmental organizations from around the world addressed a letter to China’s Ministry of Commerce in April 2020 (6) asking them to reevaluate China’s engagement in overseas coal-fired power plants.

Simultaneously, financial risks for overseas coal plants affected Chinese supply-side decision-making: Increased sovereign debt risk in many recipient countries, exacerbated by COVID-19, reduced Sinosure’s ability to provide insurance for new plants. This, possibly, led to the withdrawal of financing for a USD$3 billion planned plant in Zimbabwe in June 2021 (the Zimbabwean owner was still seeking financing in 2022). Meanwhile, with more global investors reducing financing for coal, the financing cost for coal-fired power plants increased on average by 38% in the period from 2017 to 2020 (with reference to 2007 to 2010), compared with a decrease in financing cost of 24% for offshore wind and 12% for onshore wind (7). This affected China’s ability to finance operations of overseas plants in contrast to the financing of domestic plants, for which China’s central bank has substantially expanded support since 2021 (8) to cover losses of coal plant operators.

In addition, carbon pricing schemes proliferated, which added cost risks, particularly to new overseas coal-fired power plants: In 2021, 64 carbon pricing initiatives were in operation compared with 58 initiatives in 2020 and 47 in 2018 (9). By contrast, China’s own emission trading system, introduced in 2021, is based on emission intensity (i.e., limits on tonnes of carbon dioxide per megawatt-hour) rather than cap and trade (i.e., limits on total emissions). This allows “efficient” coal plants to improve profitability by selling carbon allowances rather than having to buy them.

Finally, a 40% increase in coal price volatility and a 30% average price increase during the period from 2018 to 2021 (compared with 2015 to 2018) affected Chinese operators of all new and existing plants, except in countries with capped or controlled coal prices, including China (10).

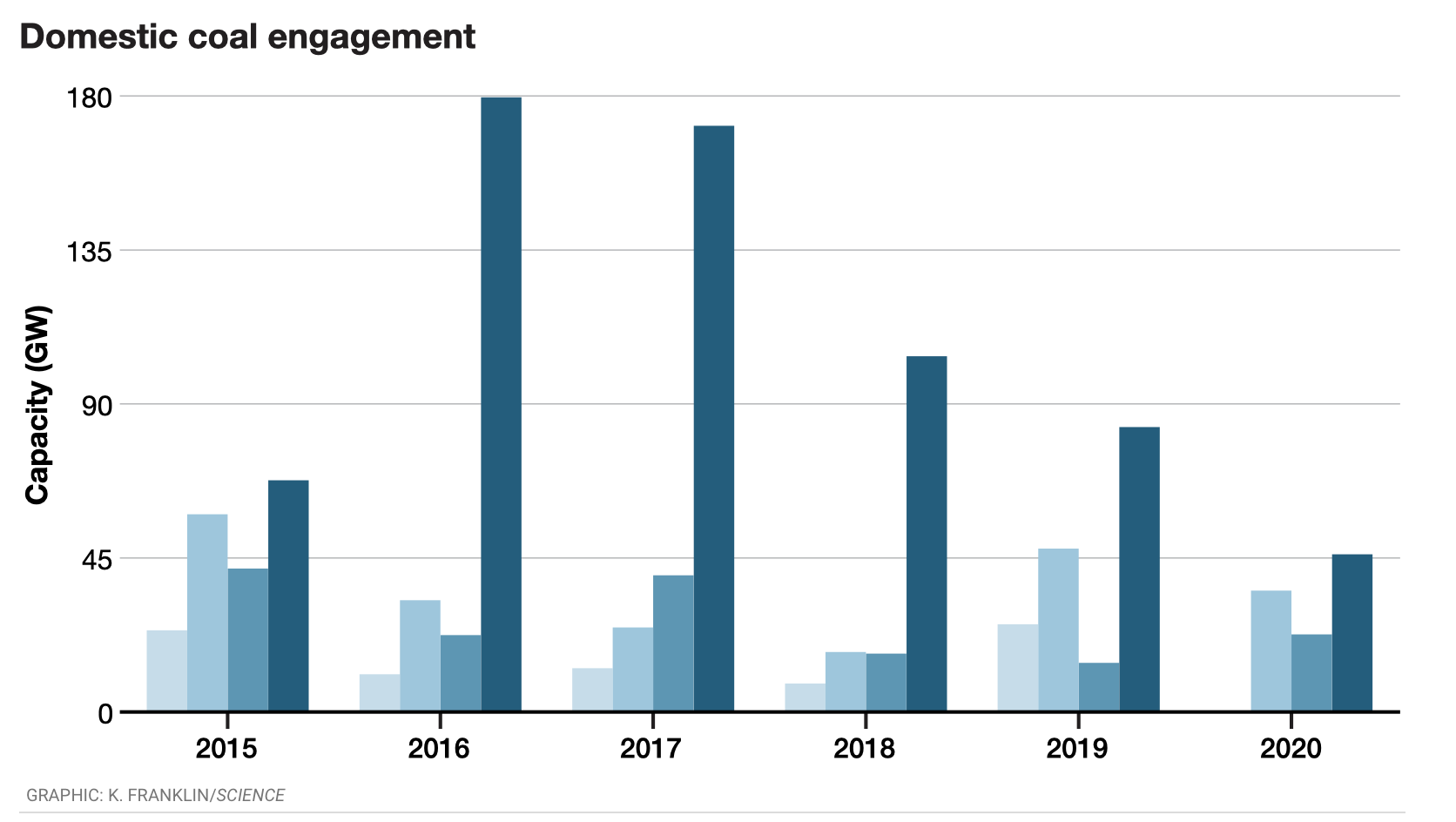

Consequently, of the 51 coal-fired power plants outside China and supported by China that were announced between the second half of 2014 and the end of 2020, only one plant became operational. By contrast, mothballing (a stop in construction) and cancellations of plants accelerated, with 25 plants shelved and 8 cancelled, which amounts to a total announced capacity of about 56 GW (see the figure). No new overseas plant was announced in 2020—a year before China’s official announcement.

The challenges in China’s overseas coal engagement allowed Chinese-led institutions that were tasked with green development, such as the Belt and Road Initiative International Green Development Coalition (BRIGC) under the Ministry of Ecology and Environment, to test the willingness of central government decision-makers to exit overseas coal under the banner of “building a green BRI.” In December 2020, the Ministry and selected government experts, including those from the National Development and Reform Commission and the China Banking and Insurance Regulatory Commission, backed the “Green Development Guidance for BRI Projects” that was developed with international support under the BRIGC, which labeled coal as “red” restricted projects (11). In February 2021, BRIGC completed a special research report that recommended a stop to overseas coal investments that was “submitted to the competent authorities and firmly underpinned the decision-making on China’s overseas coal-related investments” (12).

Once China’s political leadership made the decision to exit overseas coal, a goal seemed to be to maximize “green” soft power by providing a public top-level announcement instead of quietly reducing investments. The choice to announce at the United Nations General Assembly (UNGA) in September 2021 seemed superior for that soft-power goal compared with announcing at three other international leaders’ forums in which China participated in 2021: at the annual Boao Forum hosted by China in April, which attracted mostly Chinese and Asian leaders and audience; at the G20 summit in October in Italy; and at the UN Climate Change Conference (COP26) in November in the United Kingdom, where China would have had to share reputational gains with the hosts. China’s choice of the UNGA allowed China to present the decision as globally relevant and independent, compared with, for example, COP26, where it could have been seen as a “bargaining chip” or as being agreed to under external pressure.

Status change of Chinese-backed coal plants

Year-on-year status changes of Chinese-backed overseas coal plants and domestic coal plants are shown. Overseas coal-plants in 2020 with a capacity of 22.5 GW that had previously been announced, prepermitted, or under construction were cancelled or mothballed, whereas only 960 MW changed status from permitted to construction (top). Domestic plants that started construction increased from 14.3 GW in 2019 to 22.7 GW in 2020, whereas mothballed or cancelled plants decreased continuously from 180 GW in 2016 to 46 GW in 2020 (bottom).

In contrast to the foreign exit, China announced nonbinding ambitions to “gradually” reduce new coal plants in the future based on climate and energy policies (“1+N”) to support China’s 2060 carbon neutrality target. Practically, China expanded support of domestic coal as the “ballast stone” (baseload) to guarantee energy security after power outages in 2021, which was ironically induced by high coal prices and despite financial losses and stranded asset risks for most coal plant operators in China (13). Simultaneously, China rapidly expanded renewables (3).

Findings and Lessons

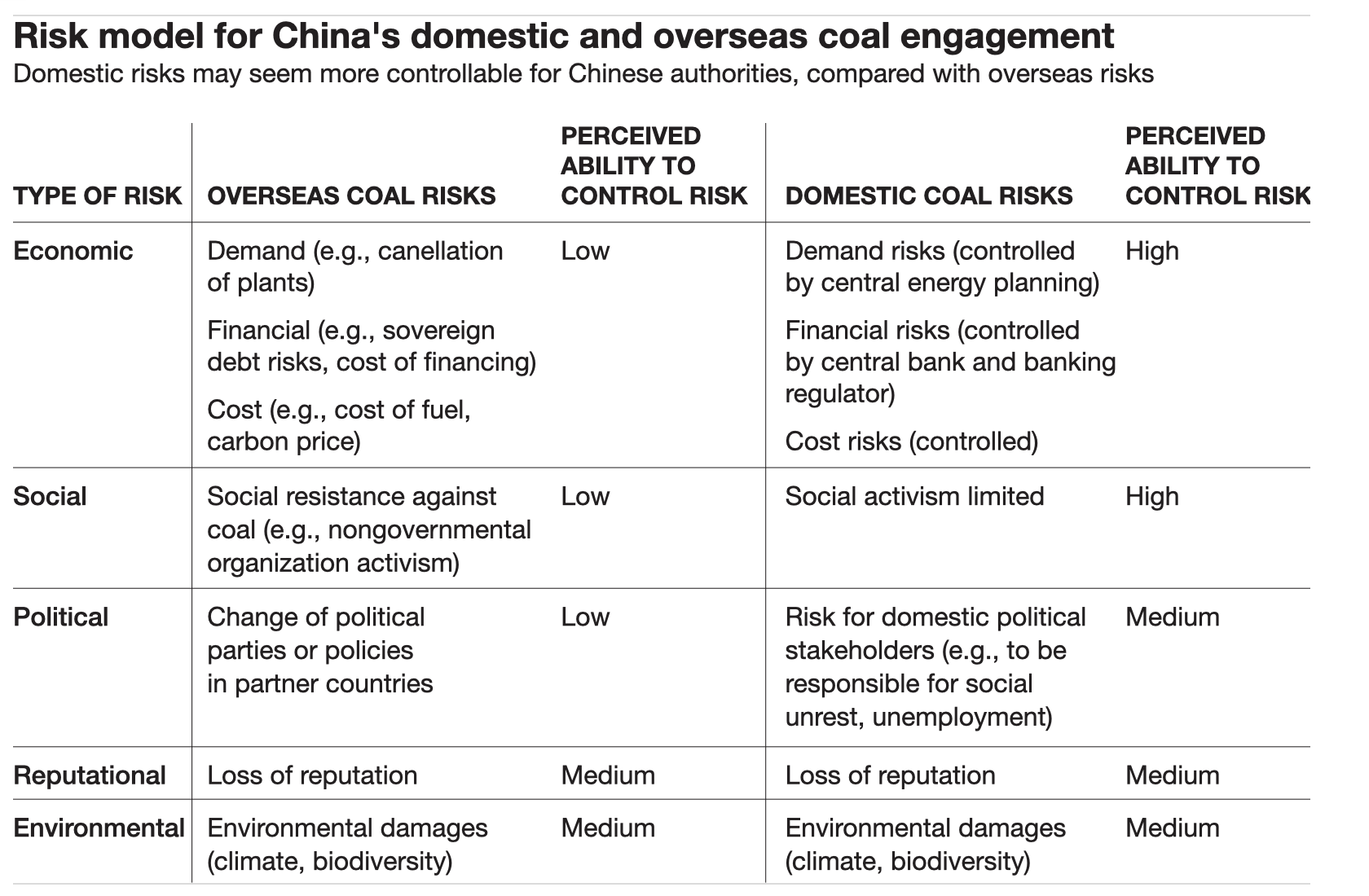

Although loopholes exist in China’s overseas coal exit (14), the contrast with China’s continued support for domestic coal suggests four findings. First, China’s overseas coal exit seems to be based foremost on economic rather than long-term environmental considerations; otherwise, China would have also committed to stop building new coal plants at home. Second, political consensus for the exit was made possible by a relatively small coalition of proexit stakeholders supported by international partners. The domestic stakeholders had the ability to reach top leadership from within the system, whereas stakeholders in recipient countries had relatively little influence. This contrasts with a more complex stakeholder landscape that opposes a domestic coal exit involving political leaders, financial institutions, and state-owned enterprises along the whole supply chain (e.g., mining, transport, generation) across different Chinese provinces. This includes millions of workers in the domestic coal sector, compared with the limited number of Chinese workers affected by China’s overseas coal exit. Third, this stakeholder complexity (and China’s dependence on coal power) makes decision-making—and even policy recommendations—toward a domestic coal exit politically riskier, with the central government embracing a loss-aversion and low-conflict strategy that supports the expansion of both coal and renewables. Fourth, China seeks green soft-power gains and uses multilateral platforms for undivided attention for Chinese environmental progress (e.g., like the announcement for carbon neutrality in 2060 at the UNGA in 2020). Various identified risks and China’s risk-control ability drive the dichotomy of China’s domestic and international coal engagement (see the table).

The variation in risks has implications for prioritizing areas of economic, policy, and technical cooperation on the environment. Importantly, these differ for domestic and overseas engagement. For domestic environmental cooperation, for example, China’s domestic coal exit or biodiversity protection, engagement opportunities are more limited to political and reputational aspects, whereas, for example, international finance’s impact would be limited in China’s large economy. First, engagement should aim to reduce complexity and risk aversion of stakeholders by targeting stakeholders on the provincial or sector level (e.g., energy, finance) with more aligned needs and a higher risk appetite, rather than focusing on commitments from China’s central government. Second, international partners can provide technical capacity and some financing in Chinese “pilot zones” with ecological mandates. This allows for targeted input of international ecological capacity and trust building between Chinese and international partners with the potential to scale experiences to other areas. Third, partners can expand knowledge diplomacy with Chinese institutions, which needs to incorporate the more-sensitive nature of domestic issues and focus on enabling local partners. By supporting exchanges between domestic and international institutions, for example, to research on just transition or green finance, international expertise can diffuse into Chinese domestic partners and thus policy deliberation.

For overseas engagement, for example, to support the retirement of China’s overseas coal plants, economic, social, political, and reputational factors can be addressed. First, China’s stakeholders would need to conclude that current nongreen engagement entails undue economic risk, for example, due to increased refinancing or operating costs (e.g., higher fuel prices, logistics prices) or even penalties (e.g., reduced financing from multilateral development banks). On the contrary, by providing support for the expansion of green activities or the reduction of harmful activities, for example, through buy-out financing like Asian Development Bank’s Energy Transition Mechanism (15), the international community can increase overseas demand for green Chinese investments. Second, international partners can expand cooperation with civil society organizations in recipient countries to support local environmental advocacy. Third, in contrast to domestic knowledge diplomacy, international partners can expand collaboration with Chinese partners with central government influence or work in established multiparty collaboration forums [e.g., BRIGC, the China Council for International Cooperation on Environment and Development (CCICED)] to jointly develop green knowledge and policies. The Chinese partner can tailor the messages to Chinese political needs and policy frameworks (e.g., “ecological civilization,” “green BRI”) and deliver it internally to leadership.

Finally, for both domestic and international cooperation, the international community can constructively acknowledge specific areas of environmental progress, which would allow China to gain desired “green soft power,” for example, through statements or study tours by international leaders (e.g., as seen in the international exploration of China’s mobility electrification). This attention should also raise the bar against retrogression.

These findings on China’s “Panda-Dragon” dichotomy in coal engagement highlight a more complex climate governance of China and should help develop more targeted cooperation strategies.

Acknowledgments

The author thanks D. de Boer, F. Champenois, C. Chang, K. Gallagher, H. Gao, C. Han Springer, and E. Wang for feedback on the drafts and data evaluation support, as well as unnamed Chinese and international policy-makers, investors, and developers for their insights. The author was an independent international researcher of the Green Development Guidance published by BRIGC and an independent international researcher for CCICED studies. All views expressed are the author’s and do not represent any official position. Data and materials used in the analysis are available to any researcher for the purposes of reproducing or extending the analysis.