-

86-21-63895588

86-21-63895588

-

No.1, Lane 600, Nanchezhan Road, Huangpu District, Shanghai 200011

No.1, Lane 600, Nanchezhan Road, Huangpu District, Shanghai 200011

Release time:2018-12-17

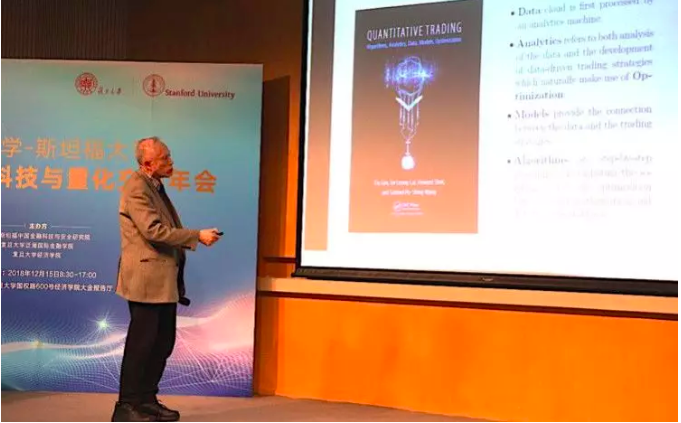

On December 15th, 2018, the 3rd Fudan-Stanford Annual Conference for Fintech and Quantitative Trading, which was jointly sponsored by Fudan University and Stanford University, was celebrated in Dajin Lecture Hall of the School of Economics at Fudan University.

Experts and scholars from academia and industry around the world were invited to the meeting. Focused on fintech, scholars delved deeply into several critical issues in the frontier of quantitative trading and tried to foresee its future progress. The conference aimed to thoroughly examine the active progress of fintech and explore its inner core, thus providing better services to banking, securities market, insurance and the real economy, and paving the way for a more reliable technology-supervision system. Meanwhile, the scholars forwarded ideas concerning concrete issues in quantitative investing, financial technology, technology supervision and financial safety, and tried to gauge the potential opportunities of innovation in fintech by combining the opinions of the insiders from Silicon Valley, Wall Street, and Lujiazui.

The participants were Li Ziliang (tenured professor of Statistics, Stanford University), Gao Huasheng (Vice Research Dean of Fanhai International School of Finance, Fudan University (FISF), professor and doctoral advisor of Finance, Fudan), Zhang Zhengjun (professor of Statistics, University of Wisconsin-Madison), Ying Zhiliang (tenured professor of Statistics, Columbia University), Zhang Chunxin (Deputy Dean of Academics of FISF, director of Fintech Research Center, professor of Finance, Fudan), Fu Chengde (professor of Finance, FISF), Zou Hao (visiting professor at Stanford, founder of Tsimage Medical), Liu Fubing (vice director of the Research Institute of Guosheng Securities, chief analyst of financial engineering), Michael Chng (Executive Dean and professor of Finance, Macau City University), and Liu Qingfu (professor of Finance, the School of Economics, Fudan (SOE)), together with other honored guests.

The full-day meeting consisted of four sections, including Innovation in Financial Technology, Technology Supervision and Robo-advisor, Quantitative Analysis and Investing, and Indices Release and Roundtable, 7 speeches and a roundtable discussion.

First, Prof. Li Ziliang delivered a speech titled as “Financial Technology, Quantitative Trading and Statistical Science”, where he pointed out that the revolution of financial technology and Big Data marked a new epoch of finance after the Great Recession in 2009. In this brand-new epoch, the study of quantitative trading, which covers all the bases from portfolio and wealth management to order management and routing, is the epitome of dynamic optimization, financial technology and risk management.

Next, Prof. Zhang Zhengjun and Fu Chengde gave introductions to the recent progress in risk management and technology regulation and newly developed algorithms in credit risk management, respectively. The arrival of new algorithms, as is believed, is not only a generalization and extension of traditional finance theory but also a blueprint for its future development. In addition, the lecture on the rise of machine-learning-assisted investment accompanied by an informative introduction to the theory of machine learning delivered by Prof. Michael Chng brought profound insights in this field.

After that, delegates from the quantitative investment and artificial intelligence industry shared their experiences about applying techniques of data analysis in related fields along with several examples of launched projects. Taking into consideration the state of Chinese macro-economy, Dr. Liu Fubing illustrated how the quantitative methods help to study Chinese market trends, identify macroeconomic risks, adjust the investment clock and allocate resources among industries. Prof. Zou sketched his thought on applying the newly-developed artificial intelligence technology to quantitative investing and put significant emphasis on taking the perspective of macroeconomy when framing investing strategies.

In what followed, Prof Liu Qingfu, on behalf of his research group at Fudan, released Research on the Competitiveness of Financial Technology in Chinese Cities, which was directed by Prof. Chen Shiyi and co-edited by post-doctoral students, and Research on Quality Index of Chinese Futures Market, which was jointly worked out by Prof. Liu Qingfu, Luo Xi and Chen Huining of the School of Economics.

In the final roundtable session hosted and organized by Prof. Zhang Chunxin, honored guests Zhang Zhengjun, Zou Hao, Liu Fubin and Ying Zhiliang delved deep into the promising potential of innovation in the field of financial technology and its future, fueling a multi-dimensional exchange of wisdom.

The meeting was co-organized by Fudan-Stanford Institute for China Financial Technology and Risk Analytics, Fanhai International School of Finance and the School of Economics. Since then, the research team has been rising to the challenges ahead, holding firmly to the thread of national economy, keeping a close eye on international economic trend, and being delicated to the construction of the globalized platform of fintech, which coalesces politics, industry, academy and research and lays foundation to high-end research and development centering the study of Big Data, AI and Blockchain. In recent years, FIST has been striding in the directions of team-building, scientific research, international collaboration, transformation of research achievements as well as services and advice about policy-making, for the accomplishment of which Prof. Lin Qingfu expressed his gratitude to Prof. Li Ziliang, representative of Stanford University, FIST, SOE at Fudan University together with supporters and sponsors from all walks.