-

86-21-63895588

86-21-63895588

-

No.1, Lane 600, Nanchezhan Road, Huangpu District, Shanghai 200011

No.1, Lane 600, Nanchezhan Road, Huangpu District, Shanghai 200011

Release time:2024-01-12

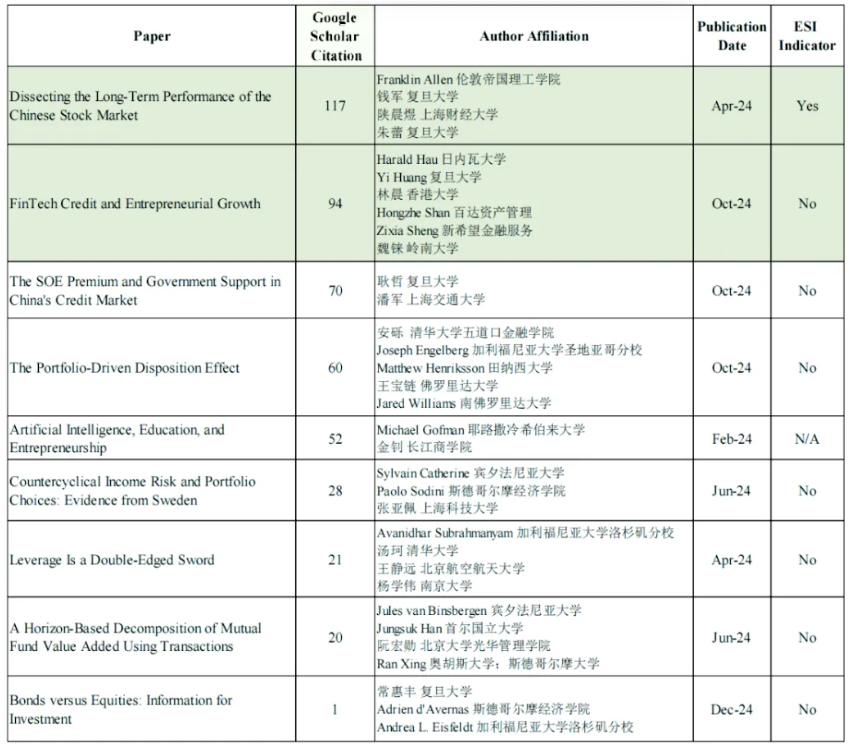

Among the list of papers published in 2024 by scholars from domestic universities in China, a total of 9 high-level research findings were published in the world-leading financial journal, Journal of Finance. Fudan University took a leading role with 4 papers, and professors from Fudan International School of Finance made expected progress by contributing 2 heavyweight papers and ranked top 2 in the citation list, which fully embodied the school’s extraordinary academic competence and expanding global influence.

Both papers of Fudan International School of Finance were telling Chinese stories on world-leading journals, one studying China’s stock market and the other studying fintech in China, both with outstanding significance and value.

In today’s world of deepening globalization, the Chinese market undoubtedly plays a significant role as the second largest economy around the world. However, to truly understand and grasp the operational law in it, in-depth research based on the native place is required.

1 Dissecting the Long-Term Performance of the Chinese Stock Market

by Jun Qian, Executive Dean of Fudan International School of Finance and Professor in Finance, Lei Zhu, Professor in Accounting, and other co-authors

Domestically listed Chinese (A-share) firms have lower stock returns than externally listed Chinese, developed, and emerging country firms during 2000 to 2018. They also have lower net cash flows than matched unlisted Chinese firms. The underperformance of both stock and accounting returns is more pronounced for large A-share firms, while small firms show no underperformance along either dimension. Investor sentiment explains low stock returns in the cross-country and within-A-share samples. Institutional deficiencies in listing and delisting processes and weak corporate governance in terms of shareholder value creation are consistent with the underperformance in stock returns and net cash flows.

The Paper of Jun Qian, Lei Zhu, Franklin Allen is Accepted and Published on Top International Financial Journal JF, Analyzing Core Factors Influencing Medium- and Long-term Performance of China’s Stock Market and Corresponding Countermeasures | Academics

2 FinTech Credit and Entrepreneurial Growth

by Yi Huang, Professor in Finance at Fudan International School of Finance, and other co-authors

Based on automated credit lines to vendors trading on Alibaba's online retail platform and a discontinuity in the credit decision algorithm, we document that a vendor's access to FinTech credit boosts its sales growth, transaction growth, and the level of customer satisfaction gauged by product, service, and consignment ratings. These effects are more pronounced for vendors characterized by greater information asymmetry about their credit risk and less collateral, which reveals the information advantage of FinTech credit over traditional credit technology.

In 2024, 14 papers by 9 professors from Fudan International School of Finance successfully got published on world-famous journals. Among them, 11 papers were included in international level-A journals, arousing widespread attention from the academic circle; 6 professors made it to the “Global List of Top 2% Leading Scientists”; 3 professors were included in the 2023 Elsevier “Highly Cited Chinese Researchers”; and 5 papers were recognized as ESI Highly Cited Papers. FISF has long been focusing on nurturing the teachers’ scientific research capability and innovation spirit and has offered a good academic environment and resource support. So far, it has a first-class teaching faculty consisting of up to 56 people, who have laid a solid foundation for the school’s academic development with their profound academic competence and frontier research findings, showcasing FISF’s academic achievements and elegant demeanour in the global stage.