-

86-21-63895588

86-21-63895588

-

No.1, Lane 600, Nanchezhan Road, Huangpu District, Shanghai 200011

No.1, Lane 600, Nanchezhan Road, Huangpu District, Shanghai 200011

Release time:2020-09-28

“The brilliance of the sun and the glory of the moon, that’s what we’ve been pursuing day after day.” For over one hundred years, Fudan spirits have been passed on generation to generation. Recently the 2020 FISF “First Class in the New Term” for freshmen came as a popular hit. Shang-Jin Wei, Academic Visiting Professor of FISF and Tenured Chair Professor of Columbia University, Bengt Holmstrom, Member of FISF International Advisory Council, Chair Professor of Paul Samuelson Economics at the Massachusetts Institute of Technology and Award Winner of Nobel Economic Prize in 2016, Ye Zhou, Member of FISF International Advisory Council and Board Chairman and CEO of Huifu Payment, and some other top experts and industry gurus gathered and presented splendid collisions of various views and opinions.

Unlike in the past, this year the 2020 “first class in the new term” was held in a bilateral way that combines both online and offline windows for the sake of the normalization of epidemic control. Professor Shiyi Chen, Secretary of the CPC FISF Committee, and Professor Jun Qian, Executive Dean of FISF, took turns giving speeches to welcome new students majoring in Elite Master of Finance, Financial MBA and Financial EMBA to the big FISF family. They also expressed their ardent expectations on the students’ study at Fudan, wishing them to “stick to their firm faith, read often and think more, stand on solid ground and absorb anything and everything”. This activity was held by Professor Charles Zhang, Deputy Dean of Academics.

Shiyi Chen

Be Enthusiastic and Aggressive, with “Four Expectations” for Achieving a Higher Level

Professor Shiyi Chen, Secretary of the CPC FISF Committee

Professor Shiyi Chen, Secretary of the CPC FISF Committee, gave his speech first. He spoke highly of the great-leap forward development FISF has made in the past three years: as an internationalized business school, FISF has always been endeavoring to make contributions to Fudan’s goal of building a world-class financial studies department, to strengthening its ability to have dialogue with international academic communities, and to construct economic and financial theories with Chinese characteristics. Moreover, with the aim of undertaking the mission of developing finance for Shanghai and the whole nation, it keeps offering guidance for the innovation of financial education in universities and colleges. Over the three years since its establishment, FISF has actively made explorations and innovations, achieving extraordinary results in varying aspects of the faculty team, academic research, talent cultivation and think-tank construction.

Meanwhile, Chen put forward “four expectations” on the new students: Firstly, I hope you can cherish our mother country and constantly learn knowledge to broaden your vision. In this time of change, you should stick to their firm faith, read often and think more, stand on solid ground and absorb anything and everything, contributing your wisdom and strength to the development of the whole country. Secondly, I hope you can take a humble and modest attitude, set off from a new starting point, and work ceaselessly to ride winds and waves to reach a higher level. Besides, I hope you can fertilize and improve yourselves for a richer inner world, and, when taking a break from study, be fully immersed in the enterprising culture of “Excellence, Responsibility and Innovation” so that the “three-wide education” can be practically specified to all aspects of life. Lastly, I hope you can make full use of the next two years at Fudan, not wasting any minute or second. Only in this way can you step forward onto a larger platform and acquire a better self.

Dialogue between Shang-Jin Wei and Bengt Holmstrom

Reliance on Dollar-dominated Assets to be the Main Source of Global Safe Assets is Unsustainable

Dialogue between Professor Shang-Jin Wei and Professor Bengt Holmstrom

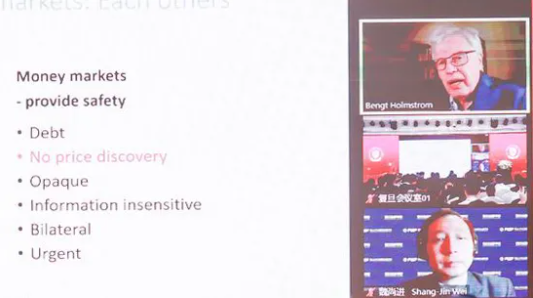

One of the “highlights” of the “first class in the new term” is the in-depth dialogue between Bengt Holmstrom, Member of FISF International Advisory Council, Chair Professor of Paul Samuelson Economics at the Massachusetts Institute of Technology and Award Winner of Nobel Economic Prize in 2016, and Shang-Jin Wei, Academic Visiting Professor of FISF and Tenured Chair Professor of Columbia University, on the topic of “features of the bond market and the shortage of safe assets”.

Starting with a time-honored financial service - the pawn shop, Professor Bengt Holmstrom analyzed the business mode of this service, i.e. financing through mortgages, and illustrated in a vivid way the reasons why the modern monetary fund market is insensitive to mortgages. Then he moved on to an in-depth analysis on the distinctions between the monetary fund market and the stock market to further explain the origin of financial crises and the causes of shadow banking. He noted that the seven significant distinctions between the two markets are dispersed in two extremes. First, the monetary fund market represents security, bringing a “parking lot” space for a large amount of capital, while the stock market offers risk pooling to investors; Second, the former is a short-term bond market while the latter is a medium- and long-term equity market; Third, the stock market has a persistent mechanism of price discovery, which does not exist in the monetary fund market; fourth, information is transparent in the stock market while contrary conditions exist in the bond market; fifth, the stock market is quite sensitive to information and the monetary fund market, in normal cases, is not sensitive at all; sixth, centralized trading is conducted in the stock market while the monetary fund market mainly relies on bilateral transactions; and lastly, the stock market liquidity requires high costs while normally the monetary fund market can provide liquidity at a low cost. So how did the financial crisis happen in 2008-2009? And what kind of special features did it show? Professor Holmstrom believed it had something to do with the fact that all global capital needs a “parking lot” for safe assets. With the demand for safe assets greater than the supply, the mortgages in the monetary fund market displayed poorer qualities and a systematic crisis hidden in this “asset shortage” broke out. Normally the monetary fund market is not sensitive to the security information of mortgages. Once a systematic event or risk occurs and the quality of the mortgages considered as safe assets declines sharply, transactions and the market may be frozen directly due to the lack of a price discovery system, leading to the outbreak of a crisis.

Professor Shang-Jin Wei pointed out that the bond market is a key instrument to provide liquidity at a low cost. By making an intensive analysis on the relation between nominal values and actual values, he noted that the government bonds are usually regarded as a form of safe assets, which is because the financial revenue of the government, rather than real things, can be taken as mortgages. On this basis, he also conducted further discussions on several frontier issues such as the distinctions between the bonds issued by the American government and those issued by other countries, the safety of the American government bonds, the influence of such bonds on the real estate market, enterprise development and people’s lives in America, as well as the direction of the development and reform of China’s bonds.

Ye Zhou

Transforming Traditional Industries with New Technology is a Digital Revolution

Ye Zhou, Board Chairman and CEO of Huifu Payment

What makes a digital revolution a digital revolution? Ye Zhou, Member of FISF International Advisory Council, Former Student of Fudan University, and Board Chairman and CEO of Huifu Payment, gave his keynote speech titled “digital revolution in finance”. He said, “transforming all the traditional industries with new Internet technology, big data and machine learning is a digital revolution. Names may vary for different industries. For the transformation of the manufacturing industry, it’s called Industrial 4.0; for the retail industry, it is called New Retail; and for the financial industry, the name is New Finance.”

He also stated that the biggest issue during the transformation process from industrialization to digitization should be the changes in the modes of production and operation. The digital revolution this time could almost affect all the industries including the service industry. Mr. Zhou elaborated on the essential properties and marketing mode of digitization from three aspects of “networking, connecting and coordinating”.

To look forward into the financial industry in the future, Zhou said, “Finance is meant to be widely linked with various industries. In the future it will no longer be carried out behind the counter in financial institutions, but in various customer scenarios. Transactions, loans and money managements will all be applied in various scenarios by financial institutions through API and other built-in services. The form of services in the financial industry will be changed fundamentally.”

Jun Qian

“Four Features” to Become Outstanding Leading Talents in Financial Industry

Professor Jun Qian, Executive Dean of FISF

Representing the faculty of FISF, Professor Jun Qian, Executive Dean of FISF, welcomed the new students majoring Elite Master of Finance, Financial MBA and Financial EMBA to the big FISF family. He opened by summarizing the “first class in the new term” with profundity and an easy-to-understand approach: Professor Holmstrom, who won the Nobel Prize in 2016, gave a speech to sum up his years of research on the underlying causes and mechanisms of the global financial crisis in 2008-2009, which is based on his solid understanding of finance and the history of the crisis as well as his extensive and unique research on financial issues. Professor Shang-Jin Wei is also an eminent scholar in economic finance. The total reference citations of all his papers on Google Scholar is 47654, ranking the first place among Chinese economists around the world. Last year he won the 2019 Contemporary Economics Prize but donated the entire bonus of one million yuan (before tax) to our school in the way of scholarships to encourage students to make meaningful studies and write high-quality theses. All incoming FISF students should learn from these two masters, not only in their erudition in economics and finance but their serious attitudes toward scientific research and teaching work. Board Chairman Ye Zhou talked about Fintech today, the most innovative, or say, “the most destructively innovative” part in the financial industry or even in the whole economic industry. From the perspective of financial practices, he shared with us cases of how innovation and implementation in financial practices promotes the development of traditional finance, is leading us to a brand new understanding of this area.

In this “first class in the new term”, Professor Jun Qian once again conveyed the school motto of “Excellence, Responsibility and Innovation” to the freshmen class. Excellence means the school’s goal of becoming a world-class financial school and cultivator of a number of world-class talents who, with professionalism, international vision and best practical experience, can play a leading role in the development of the financial system both in China and around the world. Responsibility means to have a high professional spirit. In addition to dedication to your own work, the professional ethics of financial practitioners are directly related to the healthy development of the financial industry because of its special high-risk nature. Innovation here involves two aspects. From the school, an innovative new course “live learning” has been added in the three major degree programs; and from students, we encourage and support those who dare to engage in innovation and entrepreneurship, to put what they have learned into practice, and to explore new areas and new industries in financial and economic development with the help of their own teams.

EMF Freshman Representative

We Will Link China and the World

FISF EMF Freshman Jiayi Cai

EMF Freshman Jiayi Cai was born in China and has been traveling between China and Australia since she was 9 years old. She shared her confidence in China’s future development in the financial services industry and keen expectations for the next two years’ living and studying at FISF. According to Cai, China has been universally recognized fast developing economy that has made stunning accomplishments in the financial services industry. With the further reform and opening up of China’s financial market, especially the capital market, more and more foreign investors will be drawn in as FISF students pursuing a career in the financial industry will also have more space for academic research and market potential. She stressed that FISF students, come from all over the world, and will be the essential bridge that connects China and the world in the near future. She looked forward to the day when FISF students would be able to bring back the various advanced technologies around the world and make great contributions to their country.

FMBA Freshman Representative

Ride Winds and Waves to Confront New Challenges of the Time

FISF FMBA Freshman Representative Hao Chen

FMBA Freshman Hao Chen studied at Fudan’s affiliated high school where he had long taken on the ideal and aspiration of promoting the prosperity of people. Fudan is where his dream began. After graduating from Beijing University, he worked in BNP Paribas and China Zheshang Bank. With work experiences in both Chinese and foreign banks, he has seen the convenient trading and abundant products in the foreign market and also the great enthusiasm and enormous potential for growth in the domestic market. He went on the stage as a freshman representative to express his reflections in the coming two years. “In a constantly changing and perplexing global environment, it is our task and challenge endowed by the time to figure out how to accelerate the construction and development of China’s financial market. Motivated by FISF’s goal of ‘focusing on the vision of global finance, serving the national financial strategy, cultivating top financial talents and building a top financial think-tank’, I choose to join this passionate FISF family to ride winds and waves in pursuit of my dream. I’m determined to make my own contributions to the economic development and the construction of the financial market of China, and to make a difference to this world.”

FEMBA Freshman Representative

Breakthrough Point in Variation

FISF EMBA Freshman Representative Bin Zheng

“Fudan University has a long history and a heavy academic accumulation. And the Fanhai International School of Finance where there are a number of experts from home and abroad who have made profound academic research in finance, growing ever more rapidly. I feel deeply honored to have the chance to study, to live and to make friends in this school.” FEMBA Freshman Bin Zheng was once the director of rural business of Alibaba. He said, “We have come to a changing era of intelligent business, and data has become the core production element. Driven by machine learning algorithms, innovations are becoming more frequent and uncertain, and the challenges we meet are going beyond Drucker's management thought and Schumpeter's innovation theory. That’s one important reason why I decided to return to campus for further theoretical study. Two years’ time is quite short in one’s life, but it is long enough to compose a significant chapter. There is a bond between each of us to gather here as classmates! I look forward to building a precious friendship with my teachers and classmates over the next two years.”

“Fudan, Fudan, day after day, such a glorious university of a long history. Here we have academic autonomy and can be free-spirited, with no fetters for ideological education. No fetters makes us go further. Forward, forward, go forward.”

After singing the Fudan school song, the 2020 FISF “First Class in the New Term” was concluded. Though the “first class” was over, the 2020 freshmen had just set off their journey of study at Fudan. Welcome to our big FISF family!