-

86-21-63895588

86-21-63895588

-

No.1, Lane 600, Nanchezhan Road, Huangpu District, Shanghai 200011

No.1, Lane 600, Nanchezhan Road, Huangpu District, Shanghai 200011

Release time:2025-02-24

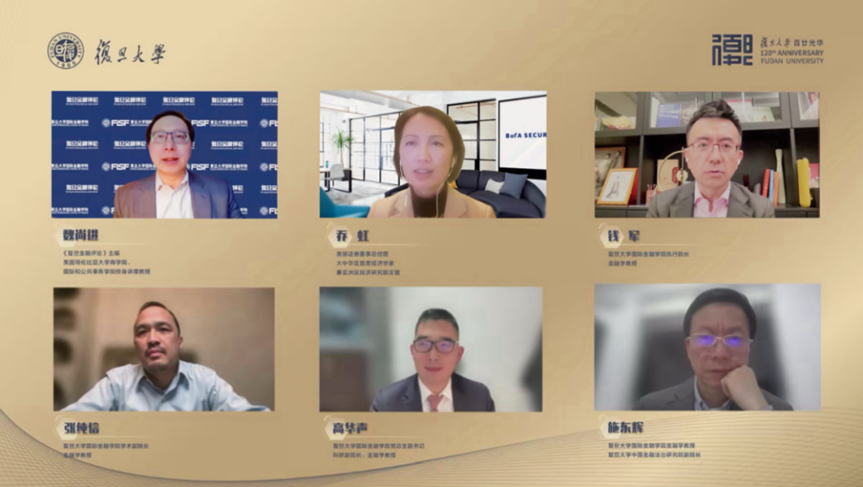

On February 20th 2025, Fudan International School of Finance New Year Forum and the 112th Fudan Financial Public Course were solemnly held. The forum was hosted by Shangjin Wei, Editor-in-chief of Fudan Financial Review and Tenured Chair Professor of School of Business and School of International and Public Affairs at Columbia University.

In the opening speech, Professor Shang-Jin Wei expressed the original aspiration of the forum. He pointed out that tech-fin had been closely related to world economic development, which was at a complex transformation stage in 2025. The global economy was growing with differentiated performances, undergoing accelerated supply chain restructuring on one hand and comprehensive reform in scientific and technological fields like AI and new energy on the other hand, injecting new vitality into economy. The invention of Deepseek and the uprising film Nezha 2 turned over the world’s impression of China. In order to help everyone seize opportunities and respond to challenges, the forum entitled 2025 Outlook: Technology, Finance, and Economy made in-depth analysis accordingly.

Hong Qiao: global economic rebound and policy expectations

Dr. Hong Qiao, Managing Director, Chief Economist of Greater China Region and Head of Asia Regional Economic Research Department of Bank of America Securities, shared her macro-outlook of global and Chinese economy. She said that the warming and rebound of the capital market after the spring festival originated from the boost in confidence brought by technological advance and innovative achievements, rather than traditional policies or data factors. She specially mentioned that the resilience of China’s economy would be fully demonstrated in 2025, with the GDP growth rate estimated to stay at around 4.5%. She also noted the significance role of combing the policy incentive mechanism in the economic rebound, particularly the increase of fiscal policies and utilization of local government special funds, which would play a critical backup part in facilitating economic growth.

Jun Qian: a turning year for China’s economy and a boost to consumption

Jun Qian, Executive Dean of FISF and Professor in Finance, focused on the several key influencing factors in the growth of China’s economy. He held that 2025 might be the “turning year” for China’s economy to witness certain initial achievements in the “conversion of old and new kinetic energy”. Specifically, the real estate market and (partial) local government debt issues were hopefully to return to stable states and recover gradually. Meanwhile, new kinetic energy with technological innovation as the core would promote the formation of multiple new ecospheres and upgrade of multiple (existing) industries, stimulating economic growth. In addition, consumption activation would also become an important driving force for economic growth. As he estimated, the government work report would maintain the annual economic growth target of around 5%, and that more active fiscal and monetary policies providing support for several special groups of people would be adopted to further boost consumption. Moreover, Professor Jun Qian also warned investors to pay attention to the Hong Kong stock market, and particularly the performances of China’s technology stocks.

Charles Zhang: technological innovation and financial empowerment

Charles Zhang, Associate Dean of FISF Academic Affairs and Professor in Finance, discussed the empowerment effect of technological innovation on the real economy in the context of digital upgrade. He stated that despite the bubbles existing in the adulation of capital markets for technological innovations, the empowerment of digital technology on the real economy just started. Technological enterprises could not develop without financial support, while it was the biggest challenge for financial institutions to break through the shackles of traditional risk assessment models. He believed the development of fintech in the future would lay more emphasis on ecology and partnership. Financial institutions would cooperate with PE/VC and incubators to jointly push forward the growth of technological enterprises. Also, he advised individuals to improve themselves so that they could better embrace the wave of digital upgrade and technological development.

Huasheng Gao: AI inclusiveness and new opportunities in the capital market

Huasheng Gao, Deputy Secretary of FISF General Party Branch, Deputy Dean of Faculty and Research and Professor in Finance, analyzed the profound influence of artificial intelligence (AI) on the financial industry. He marked that the emergence of AI technology such as Deepseek further universalized AI’s application in the financial industry and lowered the entry threshold for small players. The spread of AI technology would promote innovations in the financial industry and bring about more investment opportunities. Gao also spoke of the traditional industries and state-owned enterprises in the A-share market. Though not “stylish” enough, they still had great potentials in market value management and were expected to play a key role in driving the market value growth of the Chinese stock market.

Donghui Shi: uncertainties in the capital market and investment strategies

Donghui Shi, Professor in Finance at FISF and Vice President of Fudan University China Institute for Rule of Law in Finance, talked about future uncertainties from the perspective of capital market. He said that the biggest uncertainty faced by the capital market in 2025 would be the shock of policy shifts, geopolitical changes and technological innovations. He suggested that investors should set foot on values, investigate growth, and pay attention to high dividend assets, gold and other risk-avoiding assets when allocating assets. He also reminded investors that bubbles often exist in the adulation for technology stocks, and thus they should stay rational and avoid blindly following the trend.

At the end of the forum, Professor Shangjin Wei announced that Fudan International School of Finance would continue to release more high-quality public courses where more renowned gurus would be invited to display feasts of brilliant wisdom collisions. His own prediction of technology, finance and world economy in 2025 would be saved until the 113th public course.