In the Great Age of Carbon Neutrality, Will ESG be the Next Spotlight?

发布时间:2021-09-22

On September 16th 2021, FISF EE successfully held a Fudan Finance Course entitled “ESG and Green Transformation: value

realization from 0 to 1 - future prospect through carbon neutrality and a course explanation session of New

Commercial Financial Leadership Camp”.

At the event, Zhiqing Li, Associate Professor of the School of Economics, Fudan

University, Executive Director of Fudan Green Financial Research Center and

Teaching Professor of New Commercial Financial Leadership Camp,

analyzed from three aspects of the development background and implication of ESG, the assistance of ESG in

supporting green transformation and high-quality development, and the rating

and prospect of ESG, introducing the audience present to ESG, the only green

way to achieve common wealth.

In addition, Teacher Shiyue Yang from

the Executive Education Department gave a detailed explanation upon the

upcoming course of New Commercial Financial Leadership Camp. By carefully

selecting core financial courses and teachers at Fudan University, the course

focuses on business practices and forefront fields, and is divided into 8

modules such as the financial system and globalization, Chinese capital market and equity

investment, financial investment practices and company finance to help

enterprise senior management build a systematic financial knowledge system

within 8 months.

Firstly, Professor Zhiqing Li introduced

the development background and implication of ESG. “ESG information disclosure” refers to

the environmental (E), social (S) and company governance (G) information in the

operation process that a company actively discloses. Before it

became popular, people were more familiar with the concept of “social

responsibility investment (SRI)”, which integrates personal value orientation

and attention to society into investment decisions, considering both investment

demands and social influence. Meanwhile, it is also a mode of investment

portfolio that choose a company share structure based on ethical and social

standards. Under different social backgrounds, the content of SRI has gone

through gradual evolution, and formed a measure for investors to improve risk

and profit outcomes. Since the 1990s, environmental protection and climate

change have gradually become the focus of public attention, and thus it has

been increasingly popular to adopt environmental protection as the selection

criteria of SRI. In 2006, the Principles for Responsible Investment (PRI) was

established, officially bringing forward the concept of environment, society

and governance (ESG).

Next, Professor Li made a detailed

illustration of how ESG supports green transformation and high-quality development.

The “Zero-carbon Development” of peaking carbon emissions and achieving carbon

neutrality is the major goal of China’s mid- and long-term green development. To

promote the comprehensive green transformation of economic and social

development, the gradual disconnection between carbon emissions and economic

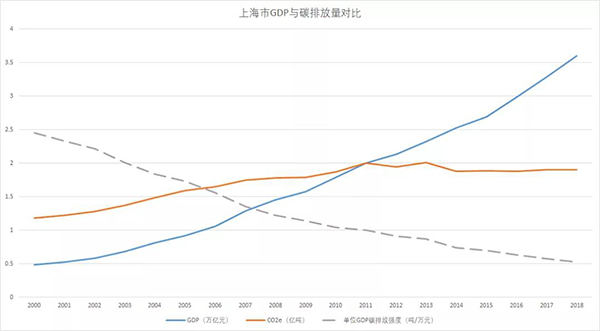

development is a must. Seeing from the “comparison diagram of the GDP and

carbon emissions in Shanghai”, Shanghai’s GDP has been rising steadily with the

increase of its carbon emissions slowing down after 2011. This is a positive

signal of moving towards the goal of green low-carbon high-quality development.

For the sake of peaking carbon emissions

and achieving carbon neutrality, China has formulated certain policies and

raised a series of requirements in the information disclosure of social

responsibilities and company governance by listed companies. So is the ESG

performance of an enterprise related to its business performance? According

to some scholars’ research, there is a certain positive relativity between ESG

performance and stock return. The investment

portfolio constructed by CSI 300 constituent stocks with the ESG performance

ranking top 100 has a higher investment income than direct investment on CSI

300 index, and the portfolio return of CSI 300 green leading stocks is also

higher than that of CSI 300 (Yao Wang, 2018). Professor Zhiqing Li took the

example of listed companies in the medical industry, concluding that the

industry group with high market value is higher in all the three aspects of the

release rate of ESG reports, average score of ESG report quality and average

increase rate of share prices compared to industry groups with medium and low

market value.

Professor Zhiqing Li explained that there are three types of

influencing principles for improper management of ESG issues, “ESG performance

directly influencing business cooperation of companies”, “ESG performance

drawing high concern of regulatory authorities and affecting core business

modes”, and “ESG performance encouraging consumers to boycott business of listed

companies”. All these will cause stock price changes of listed companies. With

investors paying more attention to ESG, the number of pan ESG index in A-share

stocks has been constantly increasing, and public funds are also more actively

applying PRI.

At last, Li shared the rating and prospect of ESG. At

present, a number of ESG rating institutions provide key information for

institutional investors to make ESG investment. Their rating methods may not

differ much, but with a certain degree of various understandings of E (environment).

In this regard, Li believed that the environmental issues facing western

countries are a great deal different from China, so there is no need and no way

for us to conform our understandings of the environment with theirs.

In the form of cases, Professor Zhiqing

Li pointed out the two forms of ESG participation of Chinese enterprises

at present. One is building an ESG governance framework and proposing a vision;

and the other is managing ESG quantitative data for its life cycle

systematically and comprehensively, and formulating ESG goals. In general, ESG

information disclosure is beneficial to the high-quality development of listed

companies in China. The era of “development before governance” and “earning

before donation” has long gone. Regulators holding new concepts are taking a

larger place, and more entrepreneurs like “Zhang Jian” will emerge in the

contemporary market.

The biggest predicament of green development is earning great acclaims but not selling well. The

biggest concern of enterprises is doing without return. So, a systematic ESG institutional

system needs to be established for enterprises to achieve economic value growth

from zero to one, so that more excellent “ESG-driven enterprises” will spring

up and a “global ESG benchmark” can be set in various industries. In this way,

more companies will recognize its advantages, giving rise to the culture and

atmosphere transformation in the entire market.

New Commercial Financial Leadership Camp opens double

visions of both the domestic and global financial market for financial

investors and senior management of entity enterprises, carrying out in-depth

exploration into enterprise investment, financing and strategic

management, discussing fintech frontier and policy reform, helping entity entrepreneurs

construct financial thinking, and leading financial institutions to better

serve entities.